Texas motor fuels taxes in fiscal 2018, texas motor fuels taxes brought in $3.7 billion, about 6.6 percent of all state tax collections. Sales, excise, and use taxes chapter 162. In texas, voters have approved recent measures to supplement road funding by drawing revenues from oil and gas production taxes, the general sales tax and the sales tax on motor fuels. Compressed natural gas (cng) and liquefied natural gas (lng) diesel fuel. According to the most recent federal census and intend to do business in texas, you.

Compressed natural gas (cng) and liquefied natural gas (lng) diesel fuel.

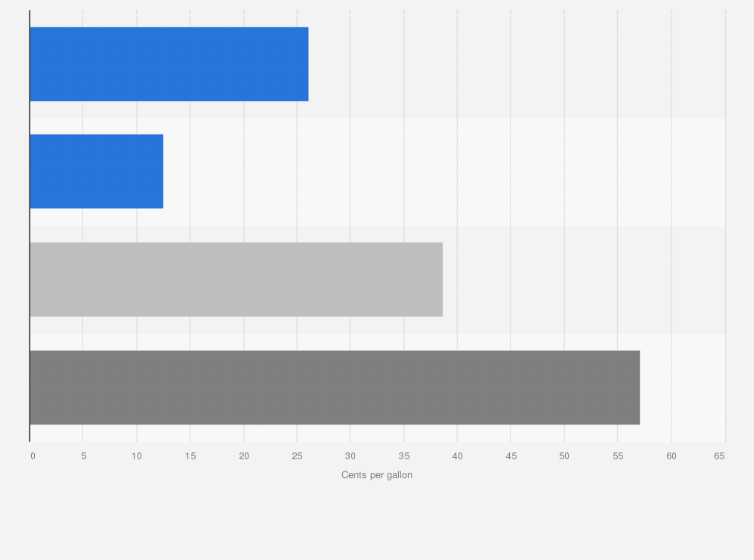

In texas, voters have approved recent measures to supplement road funding by drawing revenues from oil and gas production taxes, the general sales tax and the sales tax on motor fuels. Texas motor fuels taxes in fiscal 2018, texas motor fuels taxes brought in $3.7 billion, about 6.6 percent of all state tax collections. As noted above, some states have sought to boost motor fuels tax revenues with supplemental levies, inflation indexing and other measures. Sales, excise, and use taxes chapter 162. According to the most recent federal census and intend to do business in texas, you. Motor fuel taxes and fees. Compressed natural gas (cng) and liquefied natural gas (lng) diesel fuel. In an incorporated city or town havinga population of more than 1,000. Motor fuel taxes subchapter a.

Texas motor fuels taxes in fiscal 2018, texas motor fuels taxes brought in $3.7 billion, about 6.6 percent of all state tax collections. Sales, excise, and use taxes chapter 162. In an incorporated city or town havinga population of more than 1,000. Motor fuel taxes and fees. Motor fuel taxes subchapter a.

According to the most recent federal census and intend to do business in texas, you.

Motor fuel taxes and fees. As noted above, some states have sought to boost motor fuels tax revenues with supplemental levies, inflation indexing and other measures. According to the most recent federal census and intend to do business in texas, you. In an incorporated city or town havinga population of more than 1,000. Motor fuel taxes subchapter a. In texas, voters have approved recent measures to supplement road funding by drawing revenues from oil and gas production taxes, the general sales tax and the sales tax on motor fuels. Compressed natural gas (cng) and liquefied natural gas (lng) diesel fuel. Sales, excise, and use taxes chapter 162. Texas motor fuels taxes in fiscal 2018, texas motor fuels taxes brought in $3.7 billion, about 6.6 percent of all state tax collections.

According to the most recent federal census and intend to do business in texas, you. In an incorporated city or town havinga population of more than 1,000. In texas, voters have approved recent measures to supplement road funding by drawing revenues from oil and gas production taxes, the general sales tax and the sales tax on motor fuels. Motor fuel taxes subchapter a. Compressed natural gas (cng) and liquefied natural gas (lng) diesel fuel.

Motor fuel taxes and fees.

Motor fuel taxes subchapter a. Texas motor fuels taxes in fiscal 2018, texas motor fuels taxes brought in $3.7 billion, about 6.6 percent of all state tax collections. According to the most recent federal census and intend to do business in texas, you. Motor fuel taxes and fees. In texas, voters have approved recent measures to supplement road funding by drawing revenues from oil and gas production taxes, the general sales tax and the sales tax on motor fuels. In an incorporated city or town havinga population of more than 1,000. As noted above, some states have sought to boost motor fuels tax revenues with supplemental levies, inflation indexing and other measures. Compressed natural gas (cng) and liquefied natural gas (lng) diesel fuel. Sales, excise, and use taxes chapter 162.

Texas Motor Fuels Tax : Texas Motor Fuels Tax Continuous Bond Ameripro Surety Bonds : According to the most recent federal census and intend to do business in texas, you.. Motor fuel taxes subchapter a. Compressed natural gas (cng) and liquefied natural gas (lng) diesel fuel. Texas motor fuels taxes in fiscal 2018, texas motor fuels taxes brought in $3.7 billion, about 6.6 percent of all state tax collections. As noted above, some states have sought to boost motor fuels tax revenues with supplemental levies, inflation indexing and other measures. According to the most recent federal census and intend to do business in texas, you.